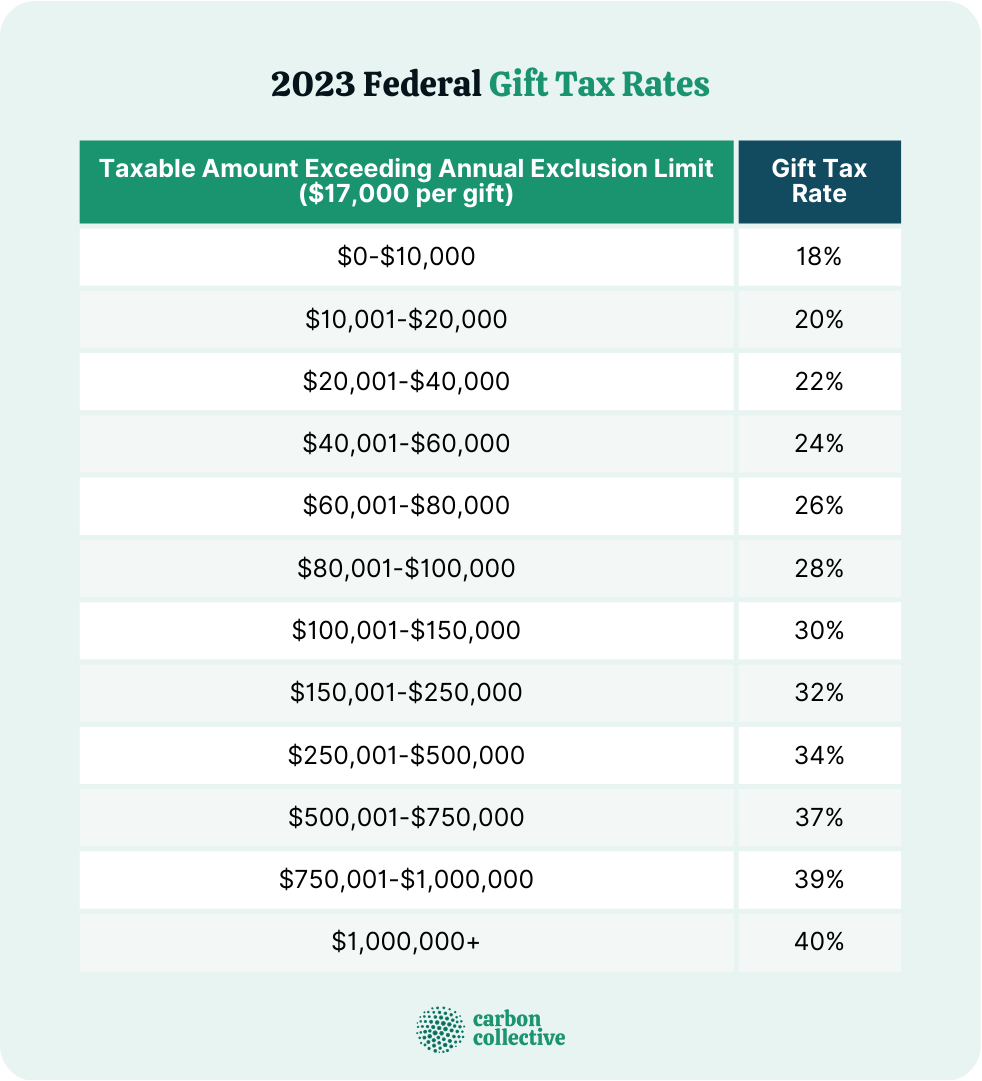

2025 Gift Tax Exemption Rules. Earlier, there were different rules to calculate tax on capital gains for different capital assets. For the calendar year 2025, the annual gift tax exclusion will increase to $19,000 per recipient, up from $18,000 in 2025.

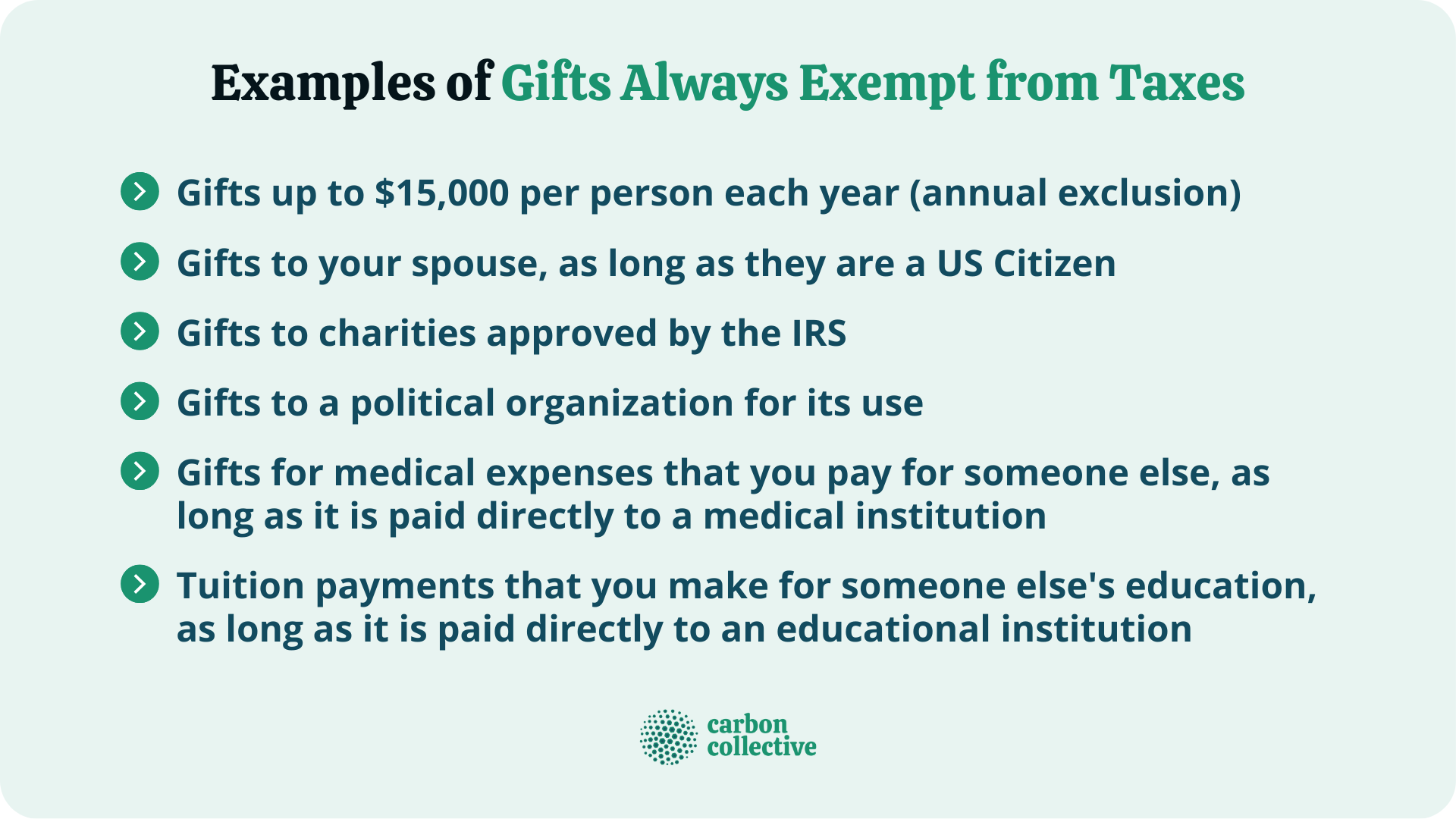

Knowing the annual gift tax exclusion can save you money and spare you from filing gift tax returns. Taxpayers should remember that the new capital gains regime is effective from july.

Gift Tax 2025 Limit Adam Vaughan, Watch this video for a breakdown of the irs gift tax rules & regulations for 2025 and 2025.

Gift Tax Rates 2025 Heather Mitchell, Speaking of the lifetime exemption, the estate and gift tax exemption will be $13.99 million per individual for 2025 gifts and deaths, up from $13.61 million in 2025.

2025 Gift Tax Exemption Rules Arleen Lenora, This means that individuals may gift up to $19,000.00 to as many recipients as he/she would like without.

2025 Gift Tax Exemption For Individuals Johna Madella, For 2025, the lifetime exemption is $13.99 million.

2025 Gift Tax Exemption Rules Arleen Lenora, Here’s what you need to know about the federal gift tax and how much you can offer.

What Are Estate and Gift Taxes and How Do They Work?, A married couple will have a combined exemption for 2025 of.