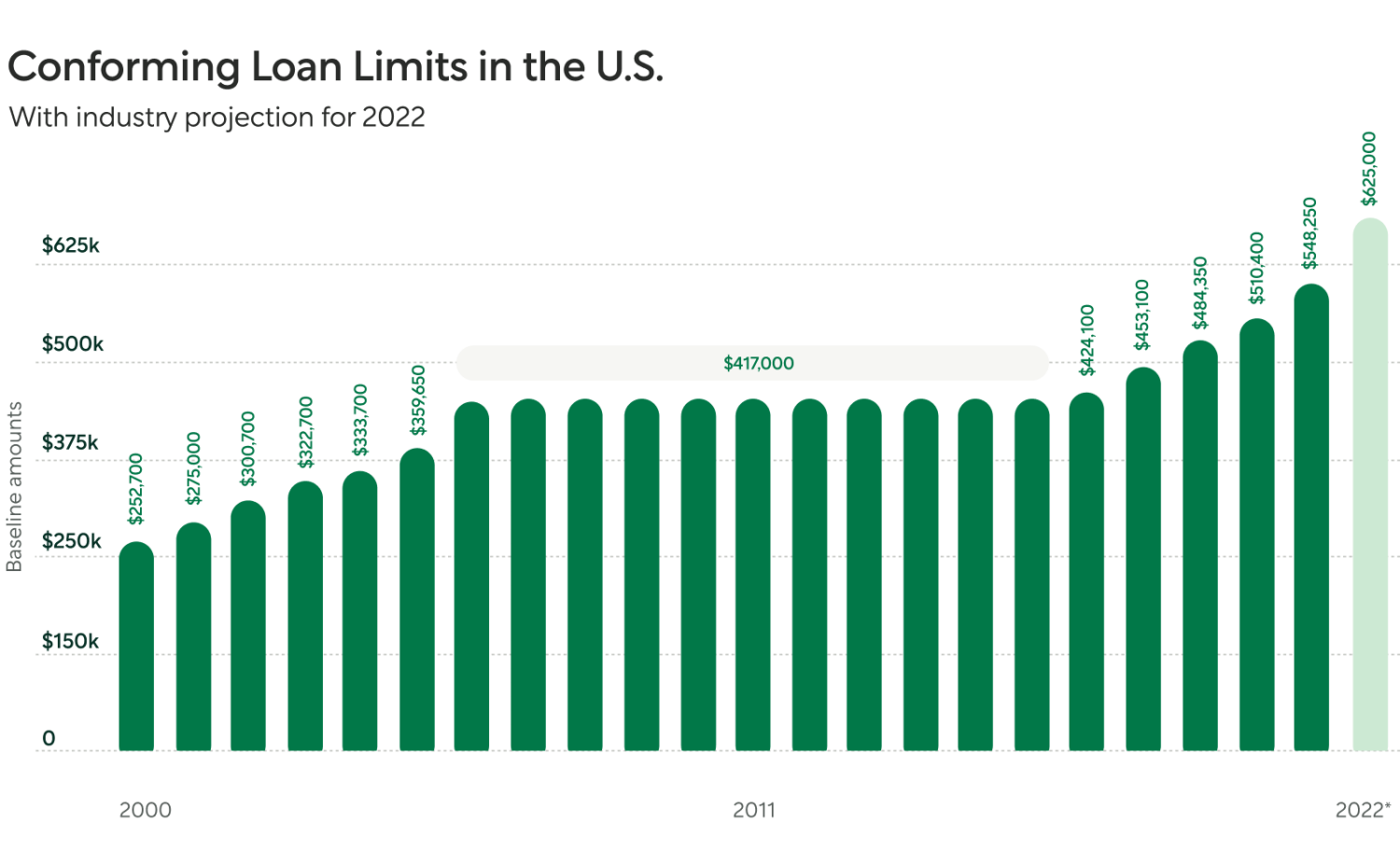

Conforming Conventional Loan Limits 2025. Conforming loan limit in 2025. The higher limit signals a response to the rapid price appreciation in the housing market.

Discover the 2025 conforming loan limits set by the fhfa for mortgages, including how they compare to 2025 limits and their impact on home loans. If you were denied a conventional loan, apply for an fha loan.

Conforming loan limits represent the maximum dollar amount you can borrow for a conforming residential mortgage.

2025 Conforming Loan Limits Intercap Lending, Conforming loan limits are a dollar cap on the amount of a mortgage that freddie mac and fannie mae will guarantee. Conforming loans meet specific guidelines fannie mae and freddie mac set, such as loan size limits.

New FHFA Conforming Loan Limits for 2025 (conventional), In response to escalating home prices in 2025, the federal housing finance agency (fhfa) has announced a 5.5% increase to the baseline (conventional) conforming loan. The projected increase in 2025 is approximately 3.28%, resulting in a new conforming loan limit of $750,000, up from $726,200 in 2025.

2025 California Conforming and FHA County Loan Limits California, That’s about a 6 percent. If you were denied a conventional loan, apply for an fha loan.

2025 Conventional Loan Limits Price Mortgage, In response to escalating home prices in 2025, the federal housing finance agency (fhfa) has announced a 5.5% increase to the baseline (conventional) conforming loan. Special statutory provisions establish different loan limits for.

Riverside County, CA Conforming Loan Limits for 2025, A conforming loan is a mortgage that meets lending rules set by fannie mae and freddie mac and is within loan limits set by the federal housing finance agency. In 2025, you can borrow up to $766,550 on a conforming loan in most areas, marking a conforming loan limit increase of $40,350 from last year's numbers.

Homebuyer Guide to 2025 Conventional Conforming Mortgage Loan Limits, On the other hand, conventional loans can also include loans. The limit is higher in alaska and hawaii, where the number is $1,149,825 for a.

Conforming Loan Limits Are Going Up Better Mortgage, The higher limit signals a response to the rapid price appreciation in the housing market. — up from $726,200 in 2025.

New 2025 Conforming Loan Limits and Why They Matter, That’s about a 6 percent. Conforming loan limits are a dollar cap on the amount of a mortgage that freddie mac and fannie mae will guarantee.

FHFA Announces Conforming Loan Limit Values for 2025 — RISMedia, Understanding conventional loan limits for 2025 and the difference between conforming vs. On the other hand, conventional loans can also include loans.

New Conforming Loan Limits Increase for 2025 Guaranteed Rate, The new limits are effective for whole loans delivered, and mortgage loans delivered into mbs with pool issue dates on or after january 1, 2025. Conforming loan limits represent the maximum dollar amount you can borrow for a conforming residential mortgage.

A conforming loan is a mortgage that meets lending rules set by fannie mae and freddie mac and is within loan limits set by the federal housing finance agency.

Here are current average rates for a variety of mortgage types to help as you rate shop in preparation for homebuying.